The Wealth Conundrum

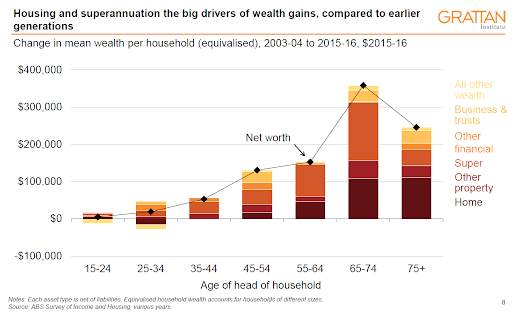

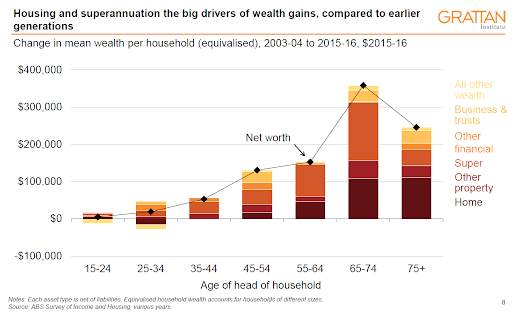

The baby boomers are retiring far wealthier than previous generations. The average retiring household has over $1 million in wealth, with much outside super (Grattan Institute).

Peter Gell, Master Tax Lawyer, has noticed a sizeable difference in estates over the past 5-7 years. He only sees the Estates getting even larger as property values increase and superannuation and pensions are not being spent, even at the minimum draw down levels.

Existing retirees do not spend their wealth in retirement. It is unlikely the boomers will either. According to the Grattan Institute, the reason for this is that nest eggs tend to stay intact during retirement – the typical retiree is a net saver. Retirees tend to spend less after they retire, and even less in old age.

The big drivers of retirees’ lack of spending decisions are unlikely to change anytime soon. Retirees worry about uncertain aged care and health costs even though government foots a lot of this bill through the public health system.

Concerns the Age Pension will disappear are vastly overblown. In 2020 the spend on the age pension was just over 2.5% of GDP and with the advent of compulsory superannuation moving through our system it is predicted there will be little change to this over the next 40 years.

With limited spending there will be greater inheritances and worsening wealth inequality, in fact the Grattan Institute predicts that without change, one in three dollars in super will be paid out as a bequest by 2059, inheritances overwhelmingly flow to older, wealthier households, worsening wealth inequality.

So, what do we as a society need to do?

Do we need to talk about taxing the family home after a certain threshold?

How should policy adapt?

Can SMSF and pension funds do without the refund of imputation credits, after all pension funds are already tax free?

Do we put incentives in place to encourage the wealthy cohort of 75 years plus to help their grandchildren buy property?